By Aarthi Aryasinha

Will legacy banks lose their relevance to the new generation? Large prominent Sri Lankan banks are slowly losing customers due to their lack of digitalization, and risk losing out to newer NEO banks if they do not adapt to the digital change.

Rajendra Theagarajah (Chairman Engenuity AI Limited) has this anecdote at a panel discussion on Internet Day recently. “My own two kids ever since they went to University in the UK even though we opened accounts for them in Barclays and Natfes, both of them immediately from University opened accounts at Monzo and today I would say 95 percent of their transactions are on Monzo, so they just keep a marginal amount in the Legacy Banks.”

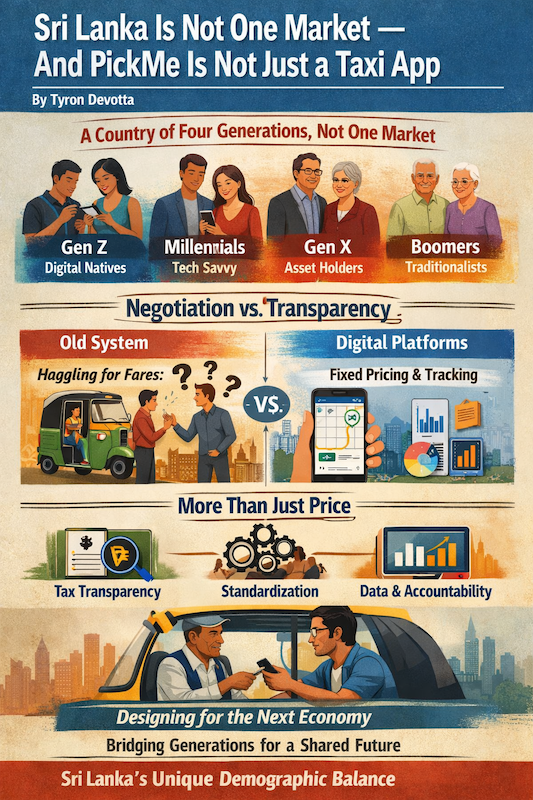

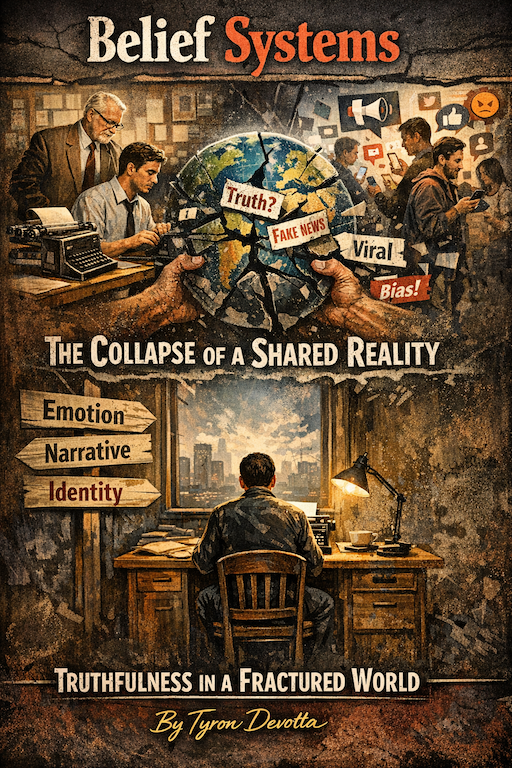

Legacy banks have to face the challenge of meeting the requirements of a newer more digital based generation, which is slated to be the future bankers of the country. Channa De Silva General Manager / CEO - LankaPay, President - FITIS Digital Services Chapter Co -Chair - Sri Lanka Internet Day LankaPay (Pvt) Ltd said “by 2024 if I'm not mistaken all the payment to government departments are mandatory going to be digital” Banks will face a number of major changes in order to digitise their infrastructure. They will have to play to the needs of the newer generation, making themselves “relevant to that customer in their own digital platform” as Randil Boteju (SVP, Digital Banking & Customer Acquisitions - Nations Trust Bank (FriMi)) said. Banks also will need to seek leniency on control by the Central Bank and different boards in order to freely be able to make quick decisions in a quickly changing market especially if controls are digitised. Bigger banks will face Legacy challenges, “the issue is really what the bigger you are the rigidity and to what extent you are able to unshackles about those things to meet the pace of agility” explained Rajan Theagarajah. If banks do not make the relevant changes through the utilisation of fintechs which are computer programs used to support banking and financial services and also adhere to the necessary cyber security challenges such as “fraud anti-money laundering, identity, cyber security threats” said Satyen Jadeja (Account Technical leader IBM India and South Asia). If those changes aren't made in the process, then they risk losing out to the proportion of people who are looking for more convenient and fast paced ways to do their day to day banking.

NEO banking is when new age banks operate without having a specific location and are digitised. A key element of why NEO banking is so popular is their convenience factor. Jadeja explained how nowadays people experience the convenience of getting an uber in 3 clicks, and now expect the same convenience for financial and more fundamental processes such as getting credit. What this will mean is that banks need to personalise their services towards each customer, Conrad Dias (Chairman LOLC Finance PLC) said “hyper personalization means you knowing your customer better.” It is now more than just servicing clients at store front. The newer generation, known as generation Z are the long term focus of banks, as they will be expecting everything to be digitised, both on a convenience perspective, but also as Theagarajah noted a carbon footprint perspective. “There will come a time when these kids when they start to bank, they will start to demand and say what is my carbon footprint. What have you as a bank or a financial service provider done to minimise this?” It is also seen abroad, where countries understand the value of digitising services such as the National Digital ID where “ India with 1.3 billion people did this in less than 4 or 5 years.” This only goes to show that the changes are possible, and there are guides and examples. “You don't have to look elsewhere for us to follow, we don't have to innovate, all you have to do is to follow.”

Policy is a key element which needs to be changed in order for banks to actually be able to make these necessary changes, in which NEO banking is able to “coexist with the conventional banking services” as Theagarajah said. Banks will need to find methods of deploying capital towards these investments into the NEO banking ecosphere, as Theagarajah stated “one conversation Sri Lanka will have to take forward about the ability to engage with a different quality of risk capital.” Banks must also look at partnerships with fintechs in order to enable them to develop further. “when it comes to the customer service side I think there is a lot that the banks can you know innovate together with the fintechs” said Dias. There are many ways in which the financial banking systems in Sri Lanka can progress, and keep its customer base, as long as they attempt to adhering to specific needs of their future customer base.

All in all, the banking system in Sri Lanka is a generational and hard set foundation, which needs to be shaken up a bit. Development has to be seen soon, more than it already is, and at a quicker pace in order for banks to be able to compete. This new generation of people have very specific needs, and as Jadeja said it is their job to “cater to them in a very rapid and digital way to address anything”

Moderator: Channa De Silva General Manager / CEO - LankaPay, President - FITIS Digital Services Chapter Co -Chair - Sri Lanka Internet Day LankaPay (Pvt) Ltd

Panelists: Rajendra Theagarajah (Chairman Engenuity AI Limited), Randil Boteju (SVP, Digital Banking & Customer Acquisitions - Nations Trust Bank (FriMi)), Conrad Dias (ChairmanLOLC Finance PLC), Satyen Jadeja (Account Technical leader IBM India and South Asia)

(The writer is a student of Media Communications and is exploring the new world of social media communication against traditional media.)